Blockchain: A Transformar Indústrias e Serviços

Blockchain has gained prominence in recent years as one of the most disruptive innovations of the 21st century. Discussions around its ability to guarantee transparency, security and decentralisation stand out not only in cryptocurrencies such as Bitcoin, but also in applications in diverse areas where the technology itself ends up being configured based on the realities of the sectors. Its potential impact is vast and could transform the way data and transactions are managed. Despite this, the topic generates polarised feelings: it is celebrated for the promise of eliminating intermediaries and empowering users, but it is also criticised for issues such as the environmental impact, the volatility of cryptocurrencies and regulatory challenges. This dichotomy reflects both enthusiasm and concerns about a technology that could redefine economic and social structures.

The concept of this technology is that of a decentralised digital ledger (peer-to-peer) which, unlike traditional client-server technologies, ensures that each node functions as both client and server. The network of nodes (computers) distributes the management of the technology, increasing security and promoting transparency. Shared data is made available and organised into blocks, which contain verifiable information, and these blocks are linked to each other using cryptography, forming a blockchain. Each block contains a set of information which, once recorded, cannot be changed or deleted without the consensus of the network, guaranteeing the immutability of the data. For example, when viewing the history of a transaction, even if someone tries to modify the data, this change will be quickly identifiable by the other participants in the network, ensuring that no false information is accepted or considered valid. In addition, the user can verify the authenticity of a document or trace the origin of a product throughout the supply chain, guaranteeing the integrity of the information and trust in the process.

Blockchain has revolutionised the traditional use of less reliable and centralised technologies, such as traditional data and transaction management systems. Currently, many organisations still use centralised methods that are often vulnerable to manipulation, human error and a lack of transparency. With blockchain, this leap is significant, as it eliminates the need for intermediaries and creates an open, accessible and highly secure network.

Although the concept of blockchain was introduced in 1991 by Stuart Haber and Scott Stornetta, it was in 2008 that Satoshi Nakamoto (pseudonym) presented the Bitcoin cryptocurrency, initiating the practical application of this technology in the financial field. Since then, blockchain has evolved beyond cryptocurrencies. This evolution is not only limited to the diversification of applications, but also to the development of different structures, with the emergence of more public or more private ecosystems, and different consensus algorithms for different needs. The public blockchain, for example, is open to any participant, guaranteeing total transparency, while private blockchains are more restricted and focused on specific users or organisations, offering greater control and privacy. In this way, blockchain continues to transform and adapt to the demands of a growing variety of contexts and challenges. Here are some examples of technology’s application in a wide variety of sectors.

Financial Sector

In the financial sector, blockchain technology has seen significant adoption, particularly in areas such as smart contracts, international transfers and regulatory compliance. This transformation is evidenced by institutions such as JP Morgan Chase, which has implemented blockchain solutions to speed up and strengthen the security of international transactions. JP Morgan’s Kinexys system has already processed more than 1.5 trillion dollars in transactions via blockchain (https://www.jpmorgan.com/insights/payments/payment-trends/introducing-kinexys).

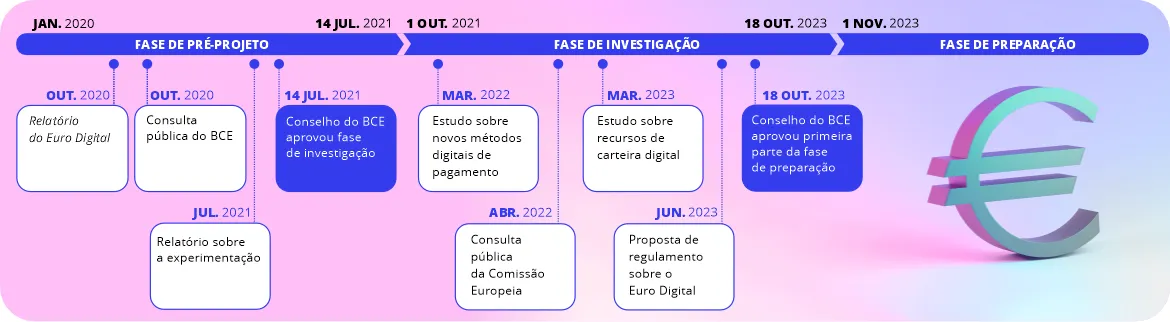

In Portugal, this evolution is also being felt, with the Bank of Portugal actively exploring the potential of blockchain technology to optimise international payments, in particular its participation in the European instant payments project and the development of the digital euro, an initiative that is currently in the preparation phase and promises to revolutionise the digital financial transactions landscape.

In the DeFi (Decentralised Finance) ecosystem, innovations are emerging that eliminate intermediaries and challenge traditional systems through decentralised protocols. Some of the main innovations include:

• Peer-to-peer lending through protocols such as Aave, where users can lend and borrow cryptoassets without the need for banking intermediaries.

• Decentralised exchanges (DEXs) such as Uniswap and PancakeSwap, which allow the direct exchange of tokens.

• Staking and yield farming in protocols such as Curve Finance, where users can obtain yields by providing liquidity.

The total value locked (TVL) in DeFi protocols exceeded 100 billion dollars in November 2024, demonstrating the growing adoption of these decentralised financial solutions.

Health

In the health sector, blockchain technology has revolutionised multiple aspects, from the management of electronic medical records to drug traceability and clinical research. Pioneering systems such as MedRec demonstrate the potential of this technology in guaranteeing privacy and controlling the accessibility of patient data, enabling the secure sharing of information between patients and healthcare professionals. At the same time, platforms such as IBM Blockchain have established strategic partnerships in the fight against drug counterfeiting, ensuring the authenticity of pharmaceutical products throughout the supply chain. This technology has also strengthened clinical research, providing greater transparency and reliability in trials, while facilitating inter-institutional collaboration and rigorous validation of the results obtained.

Retail

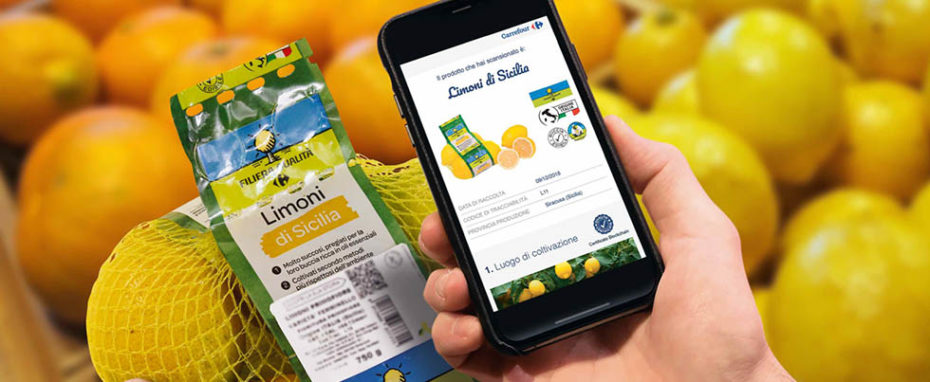

In the retail sector, blockchain technology has significantly transformed inventory management and product authentication, with notable success stories such as Walmart, which has managed to drastically reduce the time it takes to trace the origin of food products from 7 days to just 2.2 seconds. The evolution of this technology is also evidenced by the strategic partnership between IBM and iFoodDS, which allows real-time traceability of fresh produce from harvest to the end consumer, while companies such as Carrefour have implemented systems that allow consumers to verify the complete origin of products through QR codes on packaging, while contributing to the reduction of food waste through more efficient management.

In this context of innovation, Data CoLAB has been developing blockchain-based solutions for the Digital Product Passport (DPP), a strategic initiative of the European Union that aims to improve traceability, authenticity and circularity in various sectors, becoming mandatory for many products in the coming years and playing a crucial role in supporting the circular economy by providing essential information on the composition, recycling and reuse of materials, thus aligning with the EU’s sustainability and ecological transition objectives.

Other Sectors

Other uses:

Several artists have exploited NFTs (Non-Fungible Tokens) as a means of artistic expression and commercialisation of their works. They use this technology to ensure the authenticity and ownership of their digital creations.

Quim Barreiros, the iconic Portuguese musician known for his humorous lyrics, entered the universe of NFTs with a collection called QuimFT. Launched in April 2023, this initiative seeks to bring his musical legacy to the digital world, offering fans a ‘digital treasure’. The collection includes 1000 NFTs, honouring popular hits such as ‘A Cabritinha’ and ‘A Garagem da Vizinha’, allowing fans to own a unique piece of Portuguese musical culture. Purchasers of QuimFTs have access to exclusive benefits, such as backstage access at concerts, participation in future music videos, and even the possibility of hearing new releases first hand.

The integration of NFTs with virtual environments creates new forms of social and commercial interaction. Platforms such as Decentraland and The Sandbox allow users to buy virtual land, create interactive experiences and trade unique digital assets.

Based on the transformative potential of blockchain and the growing efforts to overcome its challenges, the future of this technology will be shaped by the ability to balance innovation with sustainability and responsibility. Despite technical, regulatory and environmental difficulties, ongoing initiatives to optimise energy consumption, improve interoperability and promote clear regulation are essential steps towards its consolidation. However, success will depend not only on technological developments, but also on education and raising awareness about the conscious and strategic use of blockchain.

We will continue to monitor and analyse developments in this technology, bringing you relevant updates on its progress and impact on the various sectors of the economy.